Companies have to change fast to fit evolving consumer behaviour and market trends. One very important component of this flexibility is how companies manage and treat payments. Apart from streamlining transactions, an easy payment gateway offers a wealth of information that can revolutionize corporate plans. Advanced analytics helps businesses to understand consumer preferences, spending trends, and transaction success rates. Utilizing these analytics enables decision-making that is driven by data, which has the potential to greatly improve the entire experience of the client, streamline processes, and increase profitability.

Unlocking the Payment Data Value

Payment gateways are rich data sources, not only means of transaction processing. From the moment of transaction to the mode of payment and even consumer location, every payment made through a gateway creates useful information. Using analytics allows companies to use their data to spot trends and patterns that might otherwise be missed. These realizations can help companies decide how best to approach marketing campaigns, product offers, and pricing policies.

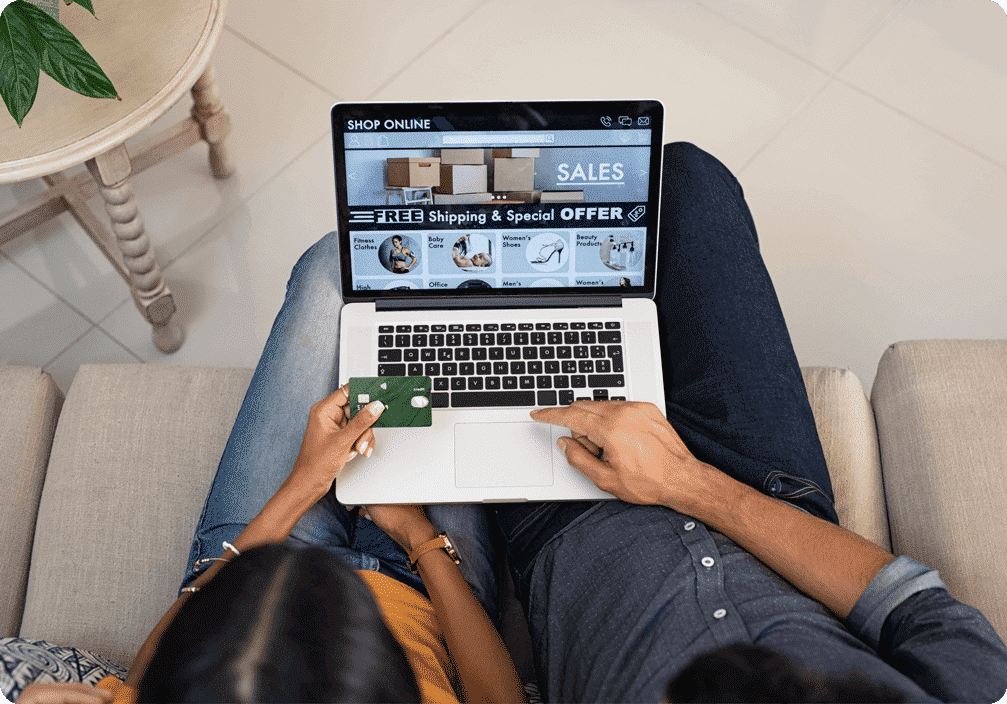

Enhancing Client Experience using Data Insights

One of the main benefits of adding analytics into payment gateways is better knowledge of consumer behaviour. Analyzing buying patterns helps companies forecast what goods or services their consumers most likely want going forward. By use of transaction data analysis, one can also find possible payment process friction points or bottlenecks, so enabling companies to enhance their payment systems and offer a more seamless, pleasurable experience. Data insights help companies provide a customized, frictionless client journey using the identification of peak transaction periods or simplification of payment alternatives.

Improving Safety and Minimizing Theft Reducing fraud threats and improving security depend also on risk analytics. Real-time tracking of every transaction by payment gateways lets companies spot odd trends or suspected behaviour. Data-driven algorithms let companies find and flag possibly fraudulent transactions before they start to cause damage. This proactive approach not only shields companies from financial losses but also fosters confidence in consumers who would feel safer utilizing the service.

One cannot stress the importance of payment analytics in contemporary corporate plans. Payment data helps businesses to make better decisions, improve consumer experiences, and guarantee more security. More than just processing payments, an easy payment gateway offers useful information that helps corporate expansion and guides wiser decisions. Businesses that adopt this data-driven approach may keep ahead of the competition and keep flourishing in an environment going more and more digital.